Fresh from the Bangkok Chaturathit Property seminar: Debt: 10 years, Thai real estate will never be the same... organized by Prop2morrow, a real estate platform, Dr. Wichai Wiratkaphan, Acting Director of the Real Estate Information Center (REIC), revealed the 10-year housing market data set of Thailand and the perspective on future market challenges. Since REIC initiated the collection of housing data of Thais nationwide for almost 30 years, there have been many changes in the real estate cycle that reflect the living conditions of Thais and the state of the Thai economy at each stage. Before the bubble crisis (before 1997), Thai real estate was in its prime, with an average of 150,000-170,000 new houses and condominiums launched per year. Before the Tom Yum Kung crisis in 1997, the market slowed down severely. The number of residences developed was in line with the demand of Thais, with only around 30,000-40,000 units registered per year. Before gradually expanding continuously in line with the expansion of the city and new investment, before 2011, the number of new house registrations in Thailand returned to a high level of 106,000 units and slowed down again during the major flood crisis, leaving less than 82,000 units per year.

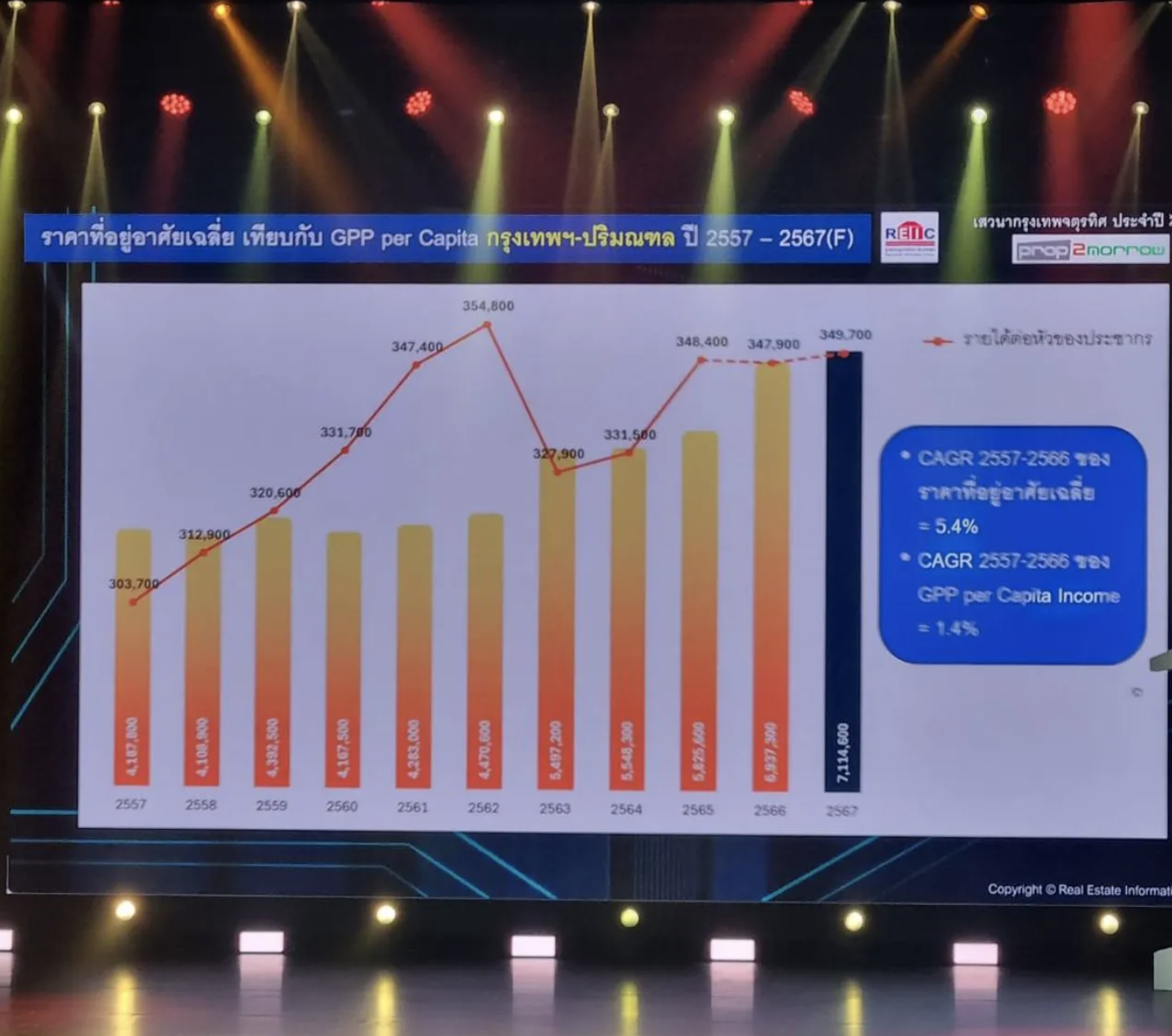

10 years ago, demand did not change, but house values increased.

However, if we consider only the past 10 years (2014-2024), the average number of new house registrations nationwide per year has returned to a high level of 130,000-140,000 units, which is a large number. There is only a black hole where the number has shrunk somewhat, amidst the sluggish economy of Thais, the spread of COVID-19, and the BOT's ironclad rule to regulate lending with the LTV measure (loan ceiling according to house value).

Dr. Wichai also stated that if we assess from historical data in each era, each economic crisis has a direct impact on the living conditions of Thai real estate, both sales and construction. Reflected from the Tom Yum Kung crisis in 1997, the number of home loans shrank to only 40 billion baht before the foreign buyer market changed. Making the Thai real estate market lively, there is the issue of buying real estate for investment and renting out, causing the value of home loans in 2018 to increase to a hundred billion baht.

In terms of the amount each year, it has not changed much, but in terms of value, it has almost doubled in the past 10 years, from 430 billion baht to 630 billion baht, reflecting that the development volume and the number of sales each year have not changed much, but the value of houses that are getting more and more expensive has caused the total market value to grow rapidly.